Wealth Management

The right approach to wealth management is the key to financial security and the freedom to live the life you love. Our personal approach helps to guide our tailored advice for your financial organisation, optimisation and protection.

Through holistic planning and protection mechanisms, our experienced advisors will best prepare you for variabilities to your finances, family, the economy and/or legislation so that you can make intelligent and measured decisions that will help you to be better off.

As an Authorised Representative of Count Financial Limited, and a Professional Partner of the Financial Planning Association of Australia, AdviceCo. provides financial planning services you can trust.

Authorised Representative of Count Financial AFSL 227232

Goal-setting and budget planning

We work closely with our clients to set financial goals that are emotionally relevant and physically attainable. A vision for your finances that excites you, such as a holiday, a renovation, or an early and comfortable retirement, or one that provides you with relief, such as philanthropy or family support, will pull you towards it, and you’ll find you’re not pushing your efforts and habits uphill.

Accurate budget planning is the enabler of your goals. With numbers in the right places, the progress is immediate and the possibilities a reality.

Shares and Managed Investments

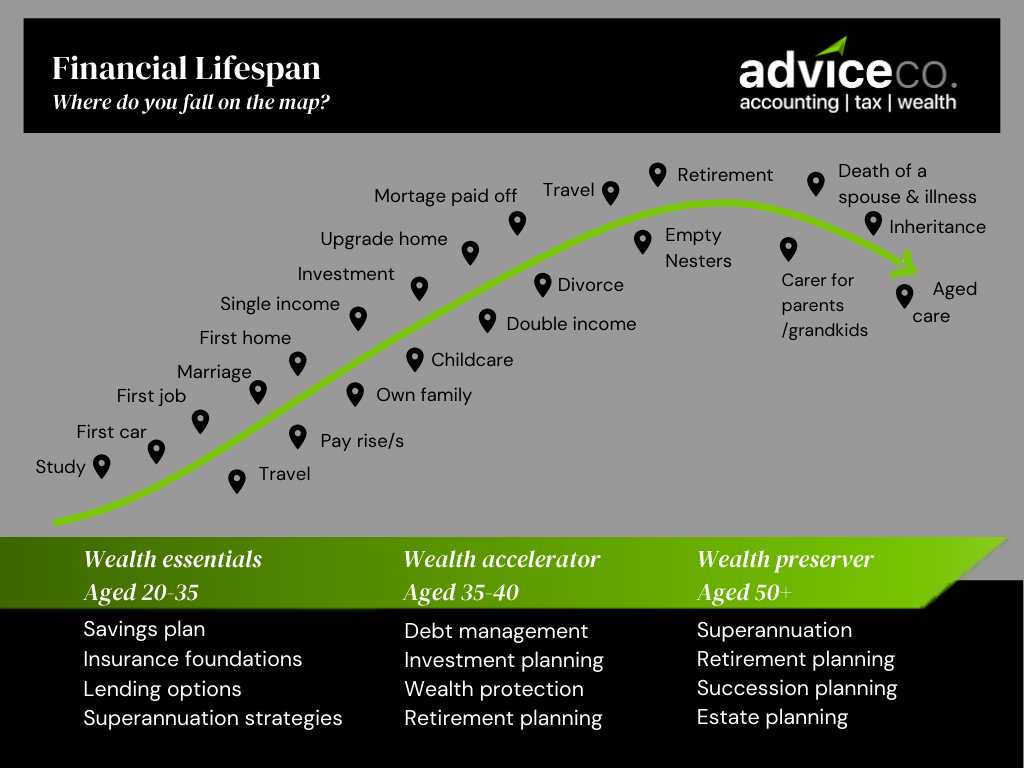

With so many investment vehicles to choose from, we assess your current versus desired state to recommend an investment portfolio that suits your needs now and into the future. Our economic expertise and knowledge of the main vehicles of managed funds, direct shares, exchange traded funds and investment bonds, as well as contemporary trends such as sharing economies helps us to design a strategy to help you be better off, no matter what stage of the financial lifecycle you are in.

Property

Buying, building or selling a residential or investment property is a significant and rewarding step in your financial life. At AdviceCo. we consider your personal lifestyle and financial aspirations, as well as market trends and opportunities to reach your goals as seamlessly as possible. It is our commitment to provide you with the information that will bring you confidence through the process, and to integrate with your team of professionals, including banks and legal advisors, to minimise complexity.

Insurance

95% of Australians are underinsured*. Life is full of unexpected events that can have a serious impact on your financial position and we believe that you not only deserve adequate protection of your hard earned assets, but that you and your loved ones need it. Our experienced team of financial advisors support clients to assess their current cover for assets and personal risk including, life, total and permanent disability, income and trauma, then navigate the myriad insurance options for informed decisions and optimum protection.

* Lifewise/NATSEM Underinsurance Report - February 2010.

Superannuation and retirement planning

No matter what stage of life you are, retirement planning is an important element of your long-term financial success. With expertise across fund review and management, market monitoring, salary sacrifice options, government co-contribution, personal, spousal and concessional contributions and pension integration, superannuation transforms from being an obligation to an enabler of your lifestyle goals.

Self-Managed Super-Funds (SMSF)

Self-managed superannuation funds (SMSFs) are a popular option for investors seeking both greater control over their retirement savings and to optimise tax concessions. Suitability will depend on your needs and circumstances. Our advisors support our clients in the end-to-end process, from research and exploration of the opportunity, feasibility and risk, to sustainable structural support and compliance.

Aged Care Planning

Whether you’re supporting your family members to access aged care, or if you’re planning your own ahead of time, it can be an emotional and complicated landscape to encounter. Professional advice will help you to understand the government and industry options and obligations, fees and charges associated with various aged care services, support programs available and the financial structures that will help you to meet specific needs in the most efficient way possible.